Public holidays can be straightforward for full-time staff: if the day falls on their usual work schedule, they get paid. Simple. But when it comes to casual employees with irregular hours, things aren’t always so clear. Employers often find themselves asking: Should I be paying them for this day off?

Getting it wrong isn’t just a small mistake. It can mean breaching the Holidays Act 2003, leading to compliance issues, payroll headaches, and even penalties.

In this blog, we’ll break down how public holidays work for casual employees, explain key terms like “otherwise working day,” and walk through what you actually need to pay. By the end, you’ll have a clearer picture of how to handle public holidays for casual employees fairly, accurately, and in line with New Zealand law.

Public Holidays Under the Holidays Act

The Holidays Act sets out the basic rules:

- If an employee does not work on a public holiday, but it is a day they would normally have worked, they must still be paid.

- If an employee works on a public holiday, they must be paid at least time and a half for those hours.

- If that day is also one they would normally have worked, they are entitled to a paid alternative holiday as well.

The tricky part that trips up many employers is working out what counts as a day the employee would “normally” work (which isn’t always clear cut). This is also called an otherwise working day. Once you understand the rules around how to work out whether it is an otherwise working day for an employee, you’ll find it’s quite simple to process public holidays for casual employees.

What is an “Otherwise Working Day”?

When deciding if an employee should be paid for a public holiday they didn’t work, the first question to ask is: Would this have been a normal working day for them if it wasn’t a public holiday?

If the answer is yes, then it’s an otherwise working day, and the employee is entitled to be paid for it. This applies to all employees, whether they’re full-time, part-time, or casual.

For example:

- A café usually rosters Sam to work on a Friday. Matariki falls on the Friday, and Sam wasn’t rostered to work because it’s a public holiday. Since Sam usually works Fridays, that day is considered an otherwise working day and Sam must be paid for it.

- On the other hand, if Sam only ever works Mondays and Wednesdays, and the public holiday falls on a Friday, it wouldn’t be an otherwise working day for him, so no payment is required.

In the example, it isn’t obvious what it means when Sam “usually” works Fridays. We’ll cover in the next section how you can be more confident when the otherwise working day should apply to an employee when they have irregular working patterns.

How Does the “Otherwise Working Day” Apply to Casual Employees?

Now that we’ve established that all employees must be paid for a public holiday that falls on an otherwise working day, the common challenge many employers face is determining when a casual employee qualifies to be paid for that day.

Unlike full-time or part-time employees who typically have set schedules and work hours, casual employees often work on an as-needed basis, with no guaranteed hours or consistent days. This unpredictability makes it extra tricky when processing public holidays. Because of this, employers need to take a range of factors into account, like recent work history and any expectations between the employee and employer. This subjectivity can lead to uncertainty and lead to potential compliance issues. But despite the subjectivity, there are ways to ensure you stay compliant with the Holidays Act 2003.

Let’s first figure out who would be considered a casual employee. While the Holidays Act 2003 doesn’t provide a strict definition, Employment New Zealand explains that casual employment usually means the employee:

- Doesn’t have a regular pattern of work.

- Works only when it suits both the employee and the employer.

- Can say no to shifts offered.

Now that we know who would need to be considered applying the otherwise working day when paying a public holiday, let’s cover how we can figure out whether they should be paid for the public holiday.

For casual staff, deciding if a public holiday is an otherwise working day involves practical and holistic judgement. Employers should look at:

- Recent work patterns — Have they consistently worked on that day of the week in the lead-up to the holiday? A simple way to take this into consideration would be to check the last 4 weeks before the public holiday to see if they have worked on that day (or taken leave on that day). If they’ve been regularly working on the same day of the week in the lead up to the public holiday, say 2 weeks or more out of the last 4, there’s a strong chance they should be paid for it as a normal day off.

- Reasonable expectations — Think about the practical reality. Based on patterns and general expectations, would the employee have likely worked (or arranged leave) on that day if it weren’t a public holiday? This is about the overall picture of what’s normal or expected for them.

- Documentation and communication — Look at the employment agreement, as well as any rosters, calendars, schedules, or communications (verbal, text, or email) between you and the employee. Do any of these indicate that both you and the employee would reasonably expect them to have worked on that day?

This assessment isn’t always black and white, but taking a fair and consistent approach helps employers remain compliant and avoid disputes. If after all considerations it’s still not clear whether the public holiday would be considered an otherwise working day for the employee, you should have a discussion in good faith with the employee to come to an agreement on whether the employee would have usually worked on that day. You should ensure that the final outcome considers all relevant factors to remain compliant with the Holidays Act 2003.

How to Pay Public Holidays for a Casual Employee

Once you’ve worked out whether a public holiday is an otherwise working day for a casual employee, the next step is deciding how much to pay them. The Holidays Act provides two ways of doing this:

| Relevant Daily Pay (RDP) | RDP refers to what the employee would have been paid if they had worked on the day in question. |

| Average Daily Pay (ADP) | ADP represents the average amount of an employee’s gross earnings per day over the last 52 weeks, or the weeks they’ve been employed for if it’s less than 52 weeks. |

When paying for a public holiday, it’s always compliant to pay the employee their relevant daily pay (RDP) if you can calculate it. However, if it’s not practicable or too difficult to work out exactly what the employee would’ve earned that day, they may instead use the average daily pay (ADP) instead.

For casual employees, ADP is often the most practical choice, since their hours and earnings can change from week to week. This variability can make it nearly impossible to calculate an accurate and compliant RDP figure, which is more frequently used for employees with default hours. In most cases, it’s not only easier but more compliant with legislation to pay casual employees using their ADP rate.

If the Casual Employee Doesn’t Work on the Public Holiday

- If it’s an otherwise working day: pay them their ADP (or RDP if you can calculate it).

- If it’s not an otherwise working day: no payment is required.

If the Casual Employee Works on the Public Holiday

- They must be paid at least time and a half for the hours worked (whether or not it’s an otherwise working day).

- If it is an otherwise working day, they also receive an alternative holiday (a paid day off at another time).

How to Pay an Alternative Holiday

The alternative holiday is paid based on what the employee would normally have earned on the day they take it off (not the public holiday they worked).

- Example: A casual employee works 3 hours on Matakriki (a public holiday). Because it was an otherwise working day, they earn time and a half for those 3 hours plus an alternative holiday. When they later take the alternative holiday on a Friday, when they normally work 8 hours, they must be paid for 8 hours, not just the 3 they worked on Matariki.

The Simple and Clear Solution: Crystal Payroll

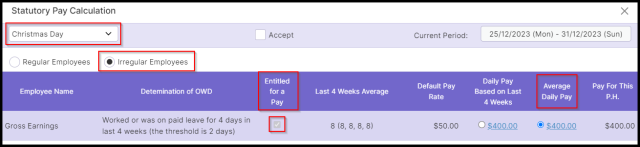

Handling public holidays for casual employees doesn’t need to be complicated. With Crystal Payroll’s Statutory Pay Calculator, you can instantly see which employees with irregular hours are entitled to be paid for a public holiday. The system also calculates their average daily pay (ADP) automatically, so you don’t have to crunch the numbers yourself.

Once you’ve confirmed who qualifies, simply click Accept to apply the payment. If the employee also worked on the public holiday, you can add those hours, and Crystal Payroll will automatically apply time and a half plus any alternative holiday entitlements.

Behind the scenes, the calculator applies the rules of the Holidays Act 2003 and relevant case law, ensuring that otherwise working days and entitlements are worked out fairly and in line with legal requirements.

Managing public holidays for casual staff can often feel like a grey area but with Crystal Payroll, it’s clear, accurate, and stress-free.

Conclusion

Public holidays and casual employees can create grey areas for employers. The key is to focus on the concept of the Otherwise Working Day—that’s what determines whether payment is required. Once that’s clear, applying the correct rate (RDP or ADP) ensures compliance with the Holidays Act.

By understanding these terms and applying them consistently, employers can stay compliant and keep payroll fair for casual employees without the stress.

And if you’d like a payroll system that takes the guesswork out of public holidays, Crystal Payroll’s Statutory Pay Calculator makes it simple. It automatically works out entitlements for irregular employees, applies the right rates, and keeps you compliant. Why not give it a go and see how simple managing public holidays for casual employees can be? Book a free demo today.

Disclaimer: This blog post is intended for informational purposes and should not be considered as financial or legal advice. Always consult with professionals for tailored guidance.