Kia ora!

With the exciting and culturally significant Matariki Public Holiday just around the corner on 14th July 2023, we at Crystal Payroll would like to express our warmest wishes to you all. We hope that this long weekend will provide a unique opportunity to immerse in New Zealand’s rich cultural heritage and share memorable moments with your loved ones. This cultural event has recently become an official public holiday as detailed in the announcement by the Parliament of New Zealand.

This blog post provides guidance for our valued clients about the upcoming public holiday and how it will impact payroll processing. As your trusted payroll partner, we aim to ensure that you’re fully equipped to navigate these special circumstances.

What is Matariki?

Before we delve into the technicalities, let’s take a moment to understand what Matariki represents. Matariki is the Māori name for the cluster of stars known as Pleiades. The rise of Matariki in mid-winter heralds the start of the New Year in the Māori calendar. It is a time for remembering the past, celebrating the present, and planning for the future. Recognizing Matariki as a public holiday is a significant step forward in celebrating and acknowledging the unique culture and heritage of New Zealand.

Unlike standard holidays tied to specific Gregorian calendar dates, Matariki follows the Māori lunar calendar, usually landing in June or July each year. The inaugural Matariki public holiday will be marked on 14th July 2023. For the specific Matariki dates until 2054, based on the lunar calendar, check the official New Zealand government announcement.

Managing Payroll during Matariki

As part of the public holiday, Crystal Payroll will be closed on Friday July 14th and will open again on Monday July 17th, but we want to ensure you’re well-prepared for handling payroll during this time. To help navigate through the scenarios that may arise, here’s a handy guide to processing public holidays in our system:

Note that an “Otherwise working day” refers to a day where an employee would normally work if it wasn’t a public holiday. For a more detailed explanation of an “Otherwise working day” you can visit Employment New Zealand’s website.

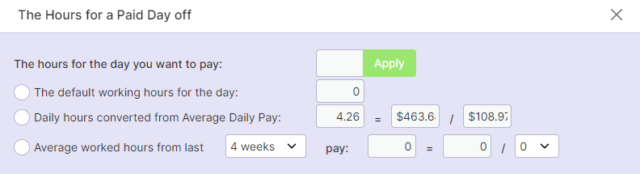

Also, note that in order to know how many hours an employee should be paid (in the case that default hours are not preset), the Crystal Payroll system is able to calculate both the Average daily pay and the Average worked hours (Also known as Relevant daily pay). Employment New Zealand has provided a guide on what both of these calculations include and how to make the choice on which one to use. In general, using Relevant daily pay will always comply with the Holidays Act 2003.

There are four different scenarios when it comes to processing public holidays.

- Taking the public holiday off because it is a “Otherwise working day”

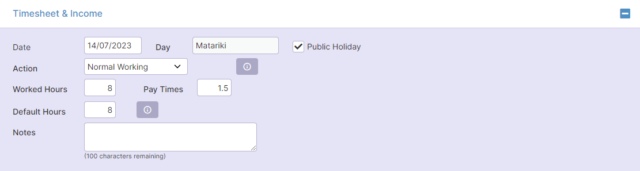

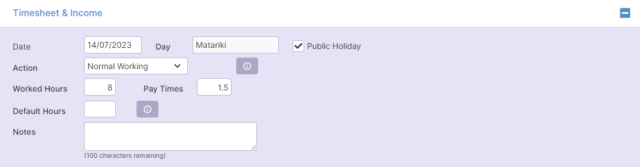

- Working on the public holiday on an “Otherwise working day”

- Working on the public holiday and it’s not an “Otherwise working day”

- Not working on the public holiday and it’s not an “Otherwise working day”

Scenario 4: Not an “otherwise working day”, not working on Matariki

In this situation, you don’t need to process an entry as the employee will not be paid for the day.

- There is no need to enter an entry at all as the employee does not need to be paid.

Remember, it’s crucial to ensure your employees are compensated correctly during this public holiday in accordance with New Zealand’s employment law.

Ensuring Compliance with Crystal Payroll

Mastering the complexities of payroll, especially during public holidays such as Matariki, is made simpler with Crystal Payroll. Our platform ensures you remain up-to-date and compliant with legislative changes, allowing you to focus on your core business operations.

Crystal Payroll ensures compliance across several critical areas:

- Tax Compliance: Automatic calculations for PAYE, Student Loan, Child Support, and ACC Levies.

- Leave Management: Simplified handling of various leave types, in line with the Holidays Act.

- Reporting: Comprehensive, legally compliant reporting for insights and transparency.

For updates on Matariki and other public holidays, the Matariki Public Holiday page on the Ministry of Business, Innovation and Employment’s website is a valuable resource.

As Matariki beckons, we invite you to discover how Crystal Payroll can simplify your payroll management. We are more than just a software provider; we are your partner in ensuring a seamless and compliant payroll experience.

Wishing You All a Happy Matariki!

As we prepare to commemorate Matariki, we wish you a joyful celebration filled with reflection and connection. As always, our team is here to support you through this public holiday and beyond. If you have any questions or need further assistance, don’t hesitate to reach out.

Ngā mihi nui, The Team at Crystal Payroll