The Basics of the RSE Scheme

The Recognised Seasonal Employer (RSE) scheme is an initiative by the New Zealand government, designed to address labor shortages in the horticultural, agricultural, and viticultural sectors. Under this scheme, when local labor falls short especially during peak seasons, employers in New Zealand have the green light to recruit seasonal workers from specific Pacific nations.

Here’s how it operates

Seasonal Employment

The scheme facilitates the employment of overseas workers for part of the year, aligning with the seasonal nature of the horticulture industry. This seasonal employment model helps to fill the labor gaps during critical periods of planting or harvesting.

Visa Requirements

Overseas workers under the RSE scheme are required to obtain a valid working visa to legally work in New Zealand. This visa lays down the terms of their employment, including the duration and employer details.

Mutual Benefits

The RSE scheme is a win-win for both parties involved. For New Zealand employers, it provides a reliable source of labor when it’s most needed, ensuring that crops are planted, tended, and harvested on time. For the workers, primarily from Pacific Island nations, it opens doors to employment opportunities, skill development, and a chance to earn income that significantly contributes to the well-being of their families and communities back home.

Key Laws and Regulations

Employment Agreements

It’s all about clarity. Employers need to have signed employment agreements with all RSE workers, spelling out the terms and conditions of employment.

Accommodation and Pastoral Care

A home away from home. Employers are to provide comfortable accommodation and ensure pastoral care for RSE workers.

Minimum Wage Compliance

As always, employers are required to adhere to New Zealand’s minimum wage guidelines. But there’s been a slight change here for RSE workers that you’ll need to know. Let’s get you updated on that in the next section!

The 2023 RSE Scheme Updates

As we approach October 1st, 2023, the RSE scheme is set to undergo significant amendments aimed at enhancing the financial security and overall well-being of RSE workers.

Here are the key updates:

Minimum Wage Increase

The minimum hourly wage for RSE workers will see a 10% increase, raising it from $22.70 to $24.97. Consequently, the minimum weekly wage (based on a 30-hour work week) will now be $749.10, up from the previous $681.00. If a worker’s earnings from piece rate work (income based on quantity produced rather than hours worked) fall below this minimum wage threshold, employers are required to top up their wages to meet the minimum requirement. Conversely, if workers earn more through piece rate work, they will be paid accordingly without any top-up. To learn more about why minimum wage top ups matter and how to automate them to guarantee compliance, check out our guide on piece rate.

More Flexible Sick Leave Entitlements

A notable change is coming to the sick leave entitlements for RSE workers. Previously, workers would receive 10 days of sick leave after six months of employment, with an additional 10 days after a year. But gone are the days of waiting six months for sick leave days. Now, workers will receive two sick leave days right from the get-go, with an additional two days accrued each month thereafter, until they reach the 10-day mark at four months of employment.

Here is a table from that shows the new RSE worker sick leave accumulation:

For more detailed information, visit Immigration NZ for the official update documentation.

These updates are a stride towards creating a brighter, fairer work environment for RSE workers, keeping in step with New Zealand’s commitment to fair employment practices and nurturing the well-being of all workers on its land.

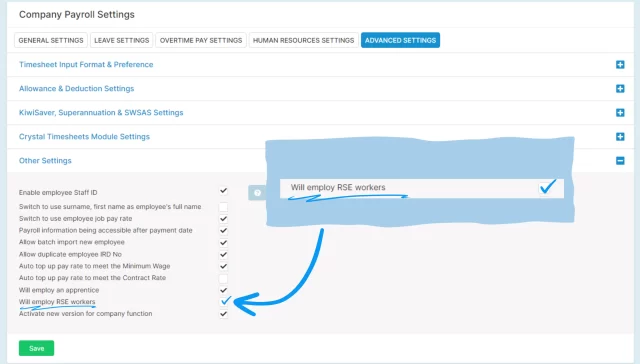

Implications for Payroll

The upcoming adjustments to the RSE scheme are not just for you to know; they will require you to make some proactive changes to your payroll processing if you want to stay on the right side of legislation. Or, have a payroll system that has taken the right steps to implement these changes for you. Let’s break down how these changes may impact your payroll operations and the steps to ensure seamless compliance.

- Updating Pay Rates: First things first, you’ll have to make sure your RSE workers are receiving that new minimum wage of $24.97. If the current pay rate for any of your RSE workers is lounging below the new minimum wage of $24.97, it’s time to give it a bump upwards. Ensuring every RSE worker’s pay rate is updated in your payroll system before the changes kick in on October 1st is your first step towards compliance.

- Sick Leave Adjustments: Next on the agenda is the new sick leave entitlement scheme which will require a bit more work to make the correct adjustments if your payroll system hasn’t implemented the updated scheme. You’ll need to ensure your payroll processes are up to speed with the new setup – two sick leave days from day one, with two more added each month until the 10-day mark at four months. If manual adjustments and record keeping of sick leave sounds like a headache, it might be a good time to check for a payroll software solution that can automate these changes. A little software magic can go a long way in keeping things streamlined!

- Staying in the Clear: Compliance isn’t just a fancy word; it’s your shield against potential audits and labor inspection visits. The last thing you want is a surprise knock on the door from the IRD because someone spotted a hiccup in your payroll. Keeping everything above board with the new RSE scheme changes is a solid move to keeping your employees happy. And remember, a happy employee is less likely to raise concerns with labor inspectors. So, ensuring your workers receive what they’re rightfully entitled to is not just about compliance; it’s about fostering a positive work environment.

- Avoiding Pitfalls: Staying informed about the RSE scheme updates is your best bet to avoid stumbling into pitfalls. It’s good practice to have a chat with your payroll provider or a knowledgeable advisor to ensure you’ve got all your bases covered.

So there you have it. A little prep work now can save you a heap of trouble later. And while you’re at it, why not explore how a trusted partner like Crystal Payroll can make navigating these changes a breeze? With the right support, you can face the upcoming RSE scheme updates with confidence and keep your focus where it belongs – on growing your business.

How can Crystal Payroll help?

Our commitment to streamlined processes is echoed by Craig Mill and Barbara Mortensen of Focus Labour Solutions Ltd. Since forming their company in Blenheim in 2008, they’ve been addressing South Island businesses’ labor demands, especially during peak times when their staff count inflates to 120 casual staff alongside 16 permanent staff. The diverse nature of their workforce, including RSE staff from Vanuatu, Kiribati, and Tuvalu, alongside Kiwi staff and backpackers, necessitated a robust payroll system capable of handling complex piece rates and paid break calculations.

Barbara Mortensen shares her experience:

We have RSE staff from Vanuatu, Kiribati, and Tuvalu and Kiwi staff and we also employ backpackers, so there’s a lot of record-keeping and you need good systems to make sure you keep on top of things and that’s where Crystal Payroll is good – particularly on piece rates. It’s in those complex piece rates and paid break calculations that Crystal Payroll really excels. Performing the calculations clearly and simply, ensuring everyone is getting paid fairly and correctly.

RSE Compliance Made Simple: Take Action Today

Ready to make the transition? Crystal Payroll is your go-to partner for navigating the RSE scheme updates with ease. Explore our offerings and see how we can make a difference in your payroll processing. Get in touch with us today, and let’s ensure your payroll system is compliant, efficient, and ready for the upcoming changes.