For a video explaining the new statutory calculator, click on this link https://youtu.be/YfzgSjpzAXM

Simplifying Public Holiday Payroll: Our New Feature

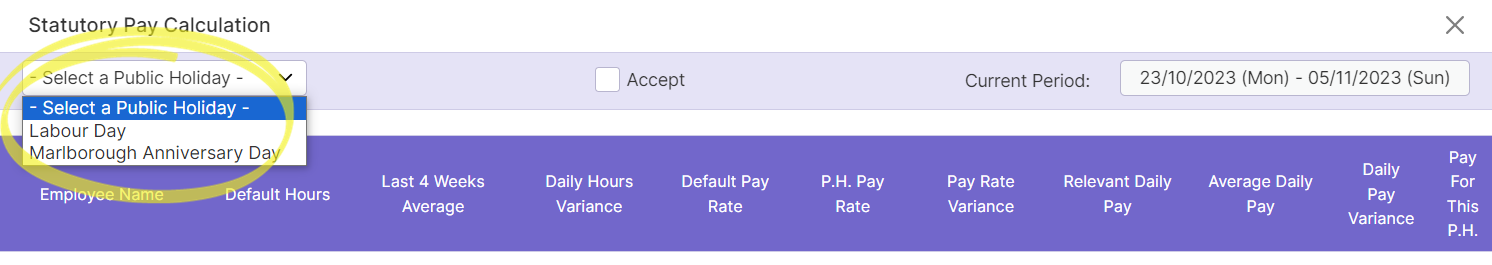

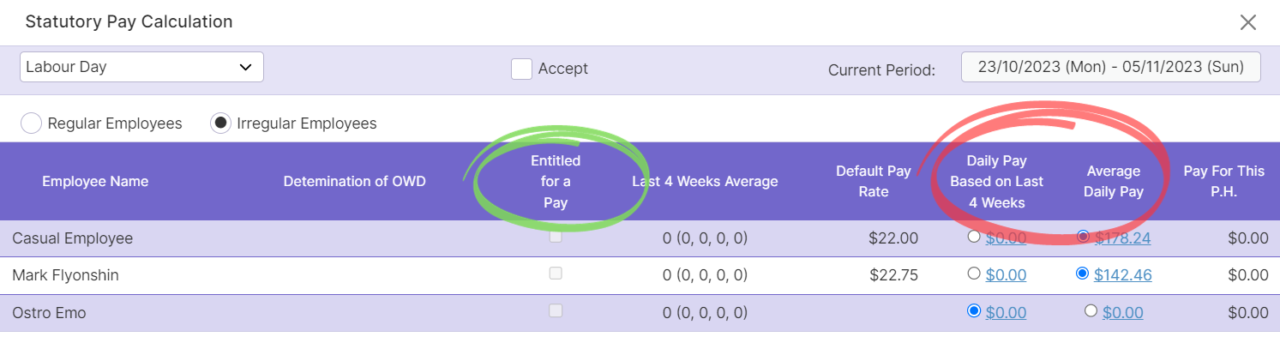

One of the hardest aspects of payroll is keeping integrity and compliance with legislation. Specifically, if you employ individuals with non-standard working patterns, determining their eligibility for statutory pay can become a challenge. As Labour Day has just passed, we’re excited to introduce a new tool – the Statutory Pay Calculator – a new tool to help determine both the eligibility of an employee with irregular working hours for public holiday pay and calculate the exact amount they’re due. Let this new tool make your Labour day payroll even more compliant and simple.

It’s straightforward to figure out the holiday pay for employees with consistent weekly schedules.

Regular Working Pattern:

Suppose you have a 40-hour-per-week employee who always works 8 hours every Monday. If they take Labour Day off, they should still receive pay for their usual 8 hours while getting to enjoy their holiday.

However, when employees don’t have the luxury of a regular working pattern. Determining the entitlement and what is to be paid to the employee becomes much more complicated due to the unpredictable working pattern.

Irregular Working Pattern:

Consider an employee who occasionally works on Mondays, with varying hours each time. Deciding if they qualify for holiday pay—and if so, how much—becomes a complex task.

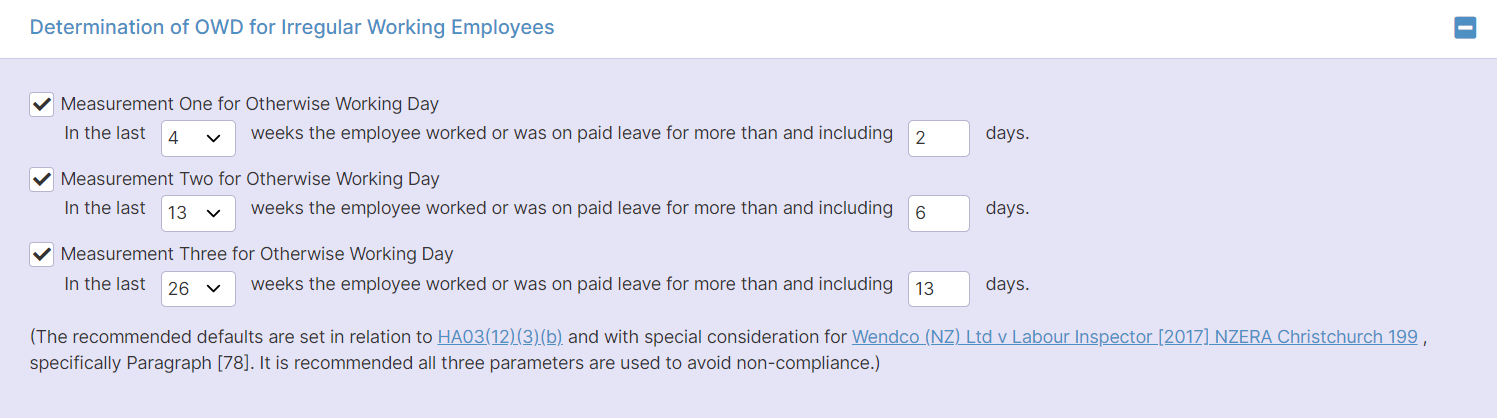

How we designed it to be fully compliant

Our latest tool incorporates both case law and provisions from the Holidays Act 2003. By default, it evaluates an employee’s work pattern over the past 4 weeks and cross-references it with a broader range spanning from a minimum of 3 months to a maximum of 6 months. This ensures an accurate determination of holiday pay entitlements.

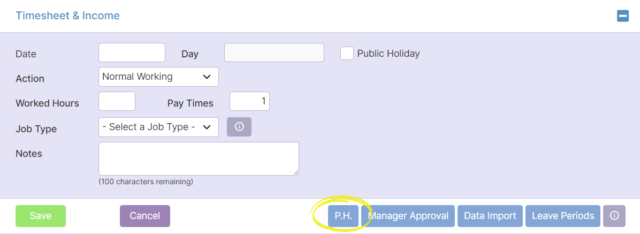

Set up is simple

For a detailed walk-through, watch our in-depth video on the feature and its setup.